Workers' compensation is a vital form of insurance that provides financial protection for employees who suffer work-related injuries and illnesses. However, there often needs to be more clarity about who is eligible for workers' compensation benefits, especially for independent contractors.

This blog post will clarify the legal distinction between independent contractors and employees and explain its implications for workers' compensation eligibility.

An independent contractor is a self-employed individual who services a company or organization. They are not considered employees and are typically hired for a specific project, task, or period. Independent contractors are responsible for managing their own business, taxes, and benefits, and they are not entitled to employee benefits such as health insurance or paid time off.

On the other hand, a regular employee is someone who works for an employer under an employer-employee relationship. They are typically hired indefinitely and are an integral part of the company, with their role and responsibilities defined by the employer. Regular employees are entitled to employee benefits, such as health insurance, retirement plans, and paid time off, and their taxes are typically withheld by the employer.

The legal distinction between independent contractors and employees is crucial because it determines the workers' classification and eligibility for certain benefits. In the eyes of the law, the main difference lies in the level of control exercised over the worker.

Independent contractors have more control over how they carry out their work and are not subject to the same rules and regulations as employees. On the other hand, employees are under the direct supervision and control of the employer.

However, in some cases, misclassification can even lead to lawsuits from injured workers seeking compensation. To avoid these consequences, it's essential for employers to carefully review the terms of their working relationship with contractors and ensure that they are genuinely independent and not under their direction or control. This includes reviewing the scope of work, working hours, and the contractor's level of independence in completing their tasks. Employers can ensure a safe and fair working environment for all by accurately classifying workers and providing the appropriate benefits.

Workers' compensation laws vary by state, but most employees are generally covered. This includes full-time and part-time employees as well as seasonal and temporary workers. Independent contractors, volunteers, and domestic workers may not be eligible for workers' compensation benefits, but it is essential to check your state's laws to determine your coverage.

However, the line between independent contractors and employees can be blurred, and employers may misclassify workers as independent contractors to avoid providing them with workers' compensation coverage. In such cases, the injured worker can seek legal help and challenge their classification to receive the benefits they are entitled to under the law.

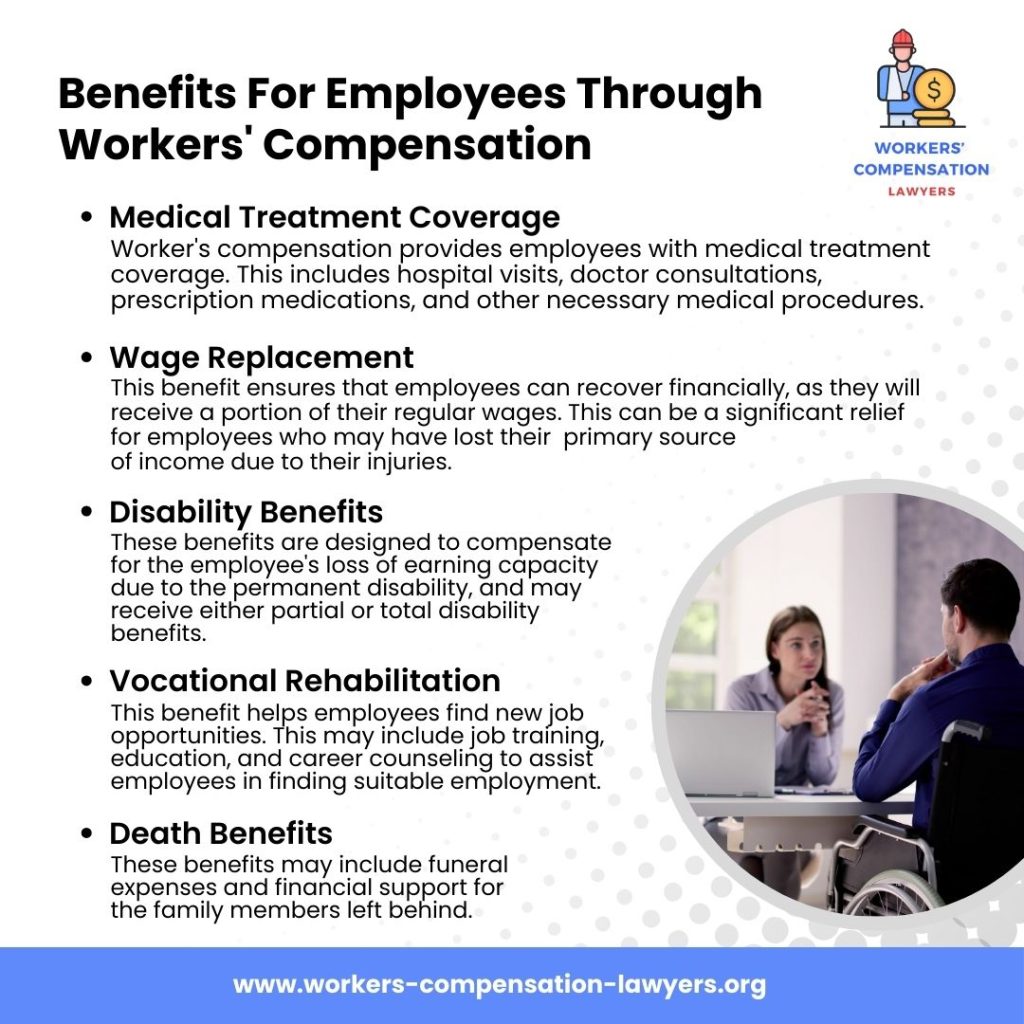

Let’s discuss the benefits available for employees through workers' compensation and why employees need to be aware of these benefits.

In the unfortunate event of a work-related injury or illness, worker's compensation provides employees with medical treatment coverage. This includes hospital visits, doctor consultations, prescription medications, and other necessary medical procedures. This coverage ensures that employees receive the best medical care and can fully recover without financial strain.

Worker's compensation also offers wage replacement benefits to employees who cannot work due to work-related injury or illness. This benefit ensures that employees can recover financially, as they will receive a portion of their regular wages. This can be a significant relief for employees who may have lost their primary source of income due to their injuries.

In cases where a work-related injury or illness results in a permanent disability, worker's compensation provides employees with disability benefits. These benefits are designed to compensate for the employee's loss of earning capacity due to the permanent disability, and may receive either partial or total disability benefits.

In some cases, a workplace injury or illness may result in an employee being unable to return to their previous job. Worker's compensation includes vocational rehabilitation benefits to help these employees find new job opportunities. This may include job training, education, and career counseling to assist employees in finding suitable employment.

In the unfortunate event of a work-related death, worker's compensation provides benefits to the employee's dependents. These benefits may include funeral expenses and financial support for the family members left behind. The death benefits aim to ease the financial burden of the employee's death and provide peace of mind to their loved ones during this difficult time.

While workers' compensation may not cover independent contractors, they still have options for financial support in case of a work-related injury or illness.

Some employers offer alternative forms of workers' compensation for independent contractors, such as Occupational Accident Insurance. This coverage is typically less expensive for employers and provides limited compensation for medical expenses and lost wages. It's essential to check with your employer to see if this coverage is available to you.

Another option for independent contractors is to have their insurance coverage. This could include health insurance, disability insurance, or Personal Injury Insurance, depending on the nature of their work. These types of insurance can provide financial support in case of a work-related injury or illness.

If an independent contractor is injured due to the negligence of a third party, they may have grounds for a third-party liability claim. For example, suppose an independent contractor is working on a construction site and is injured due to faulty equipment. In that case, they may be able to file a claim against the company that manufactured the equipment.

If you have been injured at work and are unsure if you are eligible for workers' compensation, seeking legal guidance from an experienced workers’ compensation law firm is crucial. Trusted firms like Workers’ Compensation Lawyers can help determine if you have been misclassified and fight for your rights to receive the compensation and benefits you deserve.

It is important to note that the average worker's comp settlement amount may vary depending on the case's specific circumstances, and there are particular laws and procedures in place for Workers’ Compensation Claims and Lawsuits. Also, check out our blog about "How Much Does Workers Comp Pay?" for more information on workers' compensation settlements.

If you have been injured on the job and need clarification on your classification, seeking legal help from workers' compensation lawyers is best. Don't let misclassification deprive you of the protection and benefits you are entitled to under the law. Contact us for a free consultation today, and let them fight for your rights.

***

The material on this site is for informational purposes only and DOES NOT CONSTITUTE THE PROVIDING OF MEDICAL ADVICE, and is not intended to be a substitute for independent professional medical judgment, advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions or concerns you may have regarding your health.

Disclaimer: Workers-Compensation-Lawyers.org is not an attorney referral service or a law firm. Workers-Compensation-Lawyers.org does not provide legal advice of any sort. We are a free matching service, and all claim reviews will be performed by a third party attorney. We do not recommend, nor do we endorse any attorneys that pay to participate in our service. No attorney-client relationship is formed when you submit the form and you are under no obligation to retain an attorney who may contact you through this service.

How it works

FAQs

About us

Contact us